Helping you secure capital so you can scale with confidence.

We help early-stage and growing businesses secure business funding From business lines of credit, working capital, and real estate financing, you can grow your business without relying on personal savings.

FEATURED IN

![]()

Stop self-funding

Stop using your own money to fund your business.

Every growth journey starts with capital. At Action Point Consultancy, we help founders and business owners access the funding they need to scale without relying on personal savings or inconsistent revenue. From 0% interest startup business funding to working capital, term loans, and lines of credit, our team guides you through lender matching, paperwork, and approvals. If you're ready to stop self-funding and start building with confidence, this is where your next move begins.

Funding Options

Whether you’re starting up, scaling fast, or stabilizing operations, we offer tailored solutions to match your goals.

Working Capital

Quick-access funds for any business need ideal for managing cash flow, bridging gaps, or fueling short-term growth without delay.

Term Loan

Secure a structured loan designed to support your long-term growth strategy. We help tailor loan terms that fit your business model and timeline.

Real Estate Investment Funding

Whether you’re flipping properties or building a portfolio, we provide funding for fix-and-flip, single-family, multi-family, and commercial real estate projects.

Business Line of Credit

Flexible capital on demand. Access funding when you need it, and only pay interest on the amount you use—ideal for ongoing operations and emergencies.

FAST, EASY & RELIABLE

5000+

APPLICATION

1000+

APPROVED FUNDS

$2B+

funds disbursed

95%

CUSTOMER SATISFACTION

QUICK & EASY

Get funded in 1-2-3-4... simple steps.

How Our Funding Process Works Built for Founders Even With NO REVENUE!

01

Apply Online

Fast & Easy Online Application Our loan specialist will contact you Or call us at our phone number.

02

Review Your Options

You will have options to get funding in minutes.

03

Get Funded

Loans from $5,000 – $5,000,000 receive funding in as fast as 1 day

Who we help

We help entrepreneurs who are ready to grow but need the right capital to get moving.

- Founders launching their first business and looking for startup funding

- Early-stage startups preparing to scale and needing working capital

- Self-funded businesses ready to stop dipping into personal savings

- Small business owners struggling to get approved for SBA loans, lines of credit, or equipment financing

What you get with our funding consultation

Get the guidance and support you need to qualify, apply, and get approved. Here’s what our business funding consultation includes:

- Funding Readiness Assessment

- Customized Business Funding Plan

- Access to Lenders That Fit You

- Full Application Support

TRUSTED PARTNERS WITH OVER 50+ LENDERS

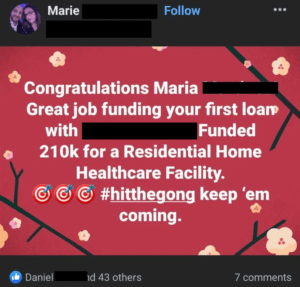

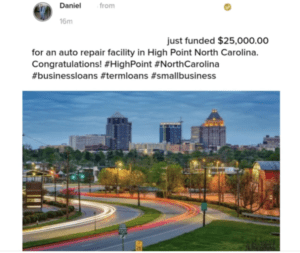

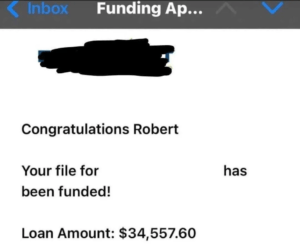

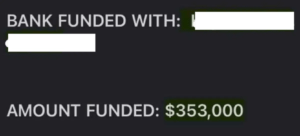

What our Beneficiaries say

Here’s what our beneficiaries have to say about their experiences with our business lending service

Frequently Asked Questions

We help you prepare for funding, connect with lenders, and structure a smart strategy for using capital. At Action Point, we support everything from financial planning to post-funding execution and business expansion.

No, you don’t need revenue, proof of revenue or bank statements to get funded. You can get up to $150,000 with no proof of revenue.

Not necessarily. As your startup business funding consultant, we evaluate your options holistically. There are creative ways to structure funding even with credit challenges. We will match you up to the best lender based on your credit score. We also have credit repair services where we will match you up with proven credit repair services that will help you get your profile attractive to lenders for funding. Regardless of your circumstances, we will help you get funding to help scale your business.

No. Our consulting is structured around a success fee model, meaning we only get paid when you do.

The best funding source for your startup depends on several factors. Early-stage startups often utilize personal savings, grants, or seed funding. As your business grows, SBA microloans, lines of credit, or working capital loans can help. At Action Point Consultancy, we recommend 0% interest business credit lines for 18–24 months. This gives you the cash runway needed to launch and grow without immediate debt pressure or giving up equity. We help startups secure flexible, interest-free funding so they can focus on building, scaling, and winning from day one.

The fastest way to get business funding is through online lenders, merchant cash advances, or short-term working capital loans. These options typically offer quicker approvals and less documentation than traditional bank loans. However, they often come with higher interest rates, so it's essential to have a repayment plan. Action Point Consultancy helps startups and small businesses get funding fast through. We guide you through the process and match you with the right lenders to speed up approval.

Get the capital you need to allow your business grow.

Whether you’re just starting or preparing to scale, the right funding can unlock your next level of growth. Let us be your trusted startup business funding consultant, providing smart guidance, lender access, and strategy that pays off.